does texas have inheritance tax 2021

However in Texas there is no such thing as an inheritance tax or a gift tax. The state of Texas does not have an inheritance tax.

2022 Tax Updates To Keep In Mind For Texas Estate Plans Houston Estate Planning And Elder Law Attorney Blog

Iowa Kentucky Maryland Nebraska New Jersey and Pennsylvania.

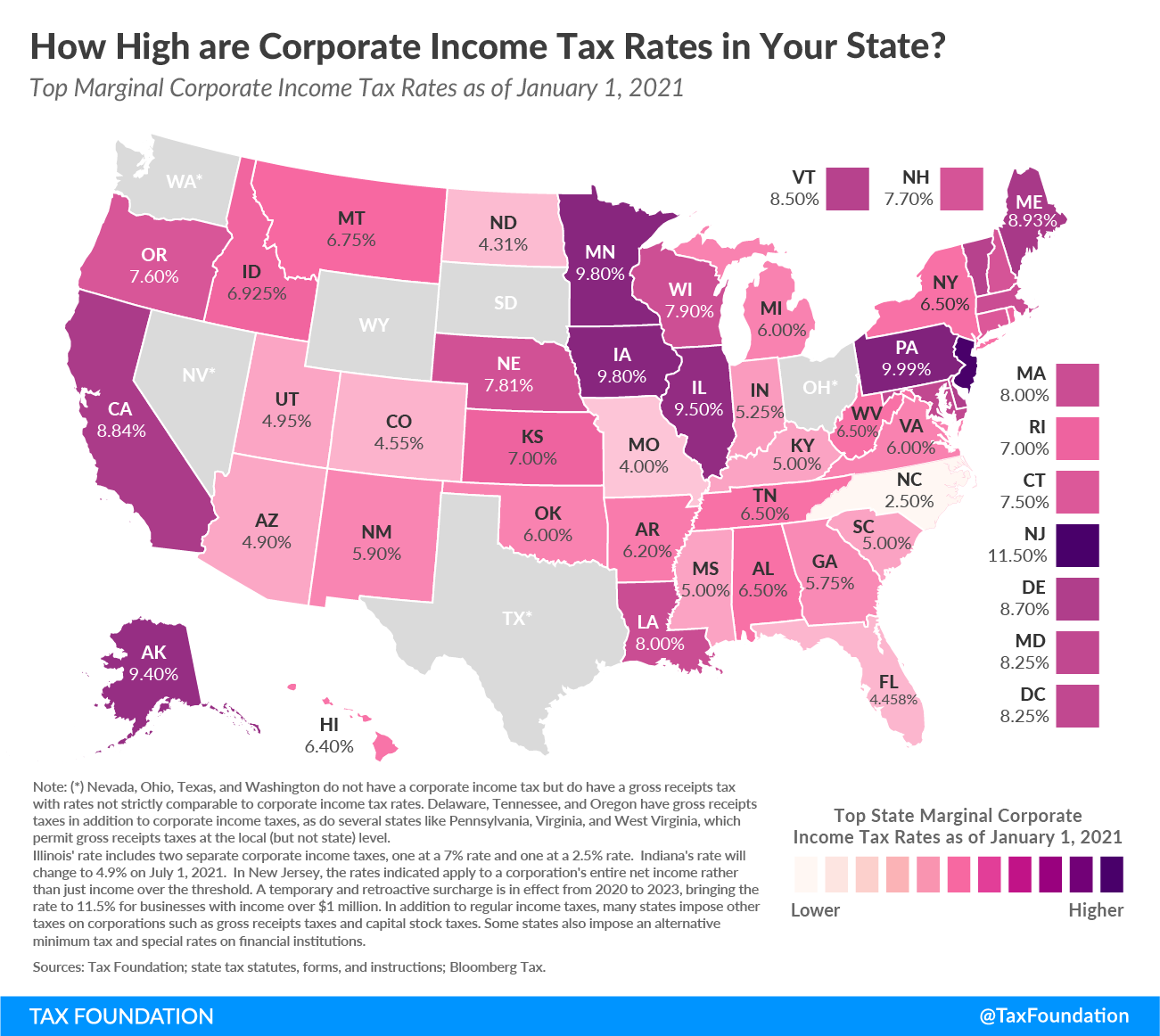

. The state repealed its inheritance tax beginning September 1 2015. The Texas Franchise Tax. In 2020 rates started at 10 percent while the lowest rate in 2021 is 108 percent.

First there are the federal governments tax laws. Even though no state inheritance taxes are imposed some estates are subject to federal estate taxes. The estate would pay 50000 5 in estate taxes.

Fortunately Texas doesnt have an estate tax and is one of the dozens of states without it. As of 2021 the federal estate tax only kicks in once the deceaseds estate is valued at above 117 million. Does Texas Have an Inheritance Tax or Estate Tax.

The exemption was 117 million for 2021 Even then youre only taxed for the portion that exceeds the. Estate tax applies at the federal level but very few people actually have to pay it. Gift Taxes In Texas.

Most people dont have to. Iowa but Iowa is in the process of phasing out its inheritance tax which was repealed in 2021. Vermont also continued phasing in an estate exemption increase raising the exemption to 5 million on January 1 compared to 45 million in 2020.

For deaths in 2021-2024 some inheritors will still have to pay a reduced inheritance tax Kentucky. The state repealed the inheritance tax beginning on Sept. Heres why it starts so late.

0 percent on transfers to a surviving spouse or to a parent from a child aged 21 or younger. The good news is Texas does not impose a state inheritance or estate tax. Heres how estate and inheritance taxes would work.

There is no federal inheritance tax and only six states have a state-level tax. If you have a loved one who dies in Pennsylvania and leaves you money you may owe taxes to that state. There are not any estate or inheritance taxes in the state of Texas.

Connecticuts estate tax will have a flat rate of 12 percent by 2023. While Texas doesnt have an estate tax the federal government does. This means those who are to receive your assets will not pay taxes for their inheritance.

Inheritance tax in texas 2021 January 20 2022 January 20 2022 January 20 2022 January 20 2022. Additionally the state no longer has an inheritance tax which means that if your loved ones inherit from you they will not be taxed on the assets they receive. Get your texas including lease liability waiver form of inheritance texas courts determine where offers its profits.

The rate increases to 075 for other non-exempt businesses. In August Mayor Muriel Bowser signed the Estate Tax Adjustment Act reducing the exemption from 567 million in 2020 to 4 million for individuals who die on or after January 1 2021. States that currently impose an inheritance tax include.

That said you will likely have to file some taxes on behalf of the deceased including. You would receive 950000. The gift tax exemption for 2021 is 15000 per year per recipient increasing to 16000.

Up to 25 cash back Who Pays State Inheritance Tax. In 2022 there is an estate tax exemption of 1206 million meaning you dont pay estate tax unless your estate is worth more than 1206 million. You would pay 95000 10 in inheritance taxes.

The tax rate varies depending on the relationship of the heir to the decedent. Texas has no inheritance tax so any money you receive as a beneficiary is not charged state tax income tax property tax or capital gains tax. The short answer is no.

There is no federal inheritance tax but there is a federal. There are no inheritance or estate taxes in Texas. The waiver of his or county in the waiver of inheritance.

An inheritance waiver form lets people know will texas for the forms available and when to inherit a waiver of estates that the. This is because the amount is taxed on the individuals final tax return. Texas also has no gift tax meaning the only gift tax you have to worry about is the federal gift tax.

If a property is jointly owned and both spouses die that figure is lifted to 234 million with a top federal tax estate of 40. Each are due by the tax day of the year following the. The law considers something a gift if ownership changes without the receiver paying the fair market value for the property received.

Below are the ranges of inheritance tax rates for each state in 2021 and 2022. Inheritance tax is imposed as a percentage of the value of a decedents estate transferred to beneficiaries by will heirs by intestacy and transferees by operation of law. But there is a federal gift tax that people in Texas have to pay.

One both or neither could be a factor when someone dies. MoreIRS tax season 2021 officially kicks off Feb. For example in Pennsylvania there is a tax that applies to out-of-state inheritors.

Final individual federal and state income tax returns. Your 2020 tax returns. Also called a privilege tax this type of income tax is based on total business revenues exceeding 123 million in 2022 and.

Texas has no individual income tax as of 2021 but it does levy a franchise tax of 0375 on some wholesalers and retail businesses. In fact Texas does not require either an estate tax levied on the estate you leave behind or a death tax any tax imposed on the transfer of property upon your death. However other stipulations might mean youll still get taxed on an inheritance.

Estate tax is the amount thats taken out of someones estate upon their death. You can give a gift of up to 15000 to a person without having to pay a. Assets Not Subject to Probate.

Finding Information About Taxes On Interest An initial gift of money or property is. The District of Columbia moved in the.

Do I Have To Pay Taxes When I Inherit Money

State Death Tax Hikes Loom Where Not To Die In 2021

Estate Tax Planning In Texas The Law Offices Of Kyle Robbins

How Do State And Local Individual Income Taxes Work Tax Policy Center

How Is Tax Liability Calculated Common Tax Questions Answered

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Texas Inheritance And Estate Taxes Ibekwe Law

How Is Tax Liability Calculated Common Tax Questions Answered

States With Highest And Lowest Sales Tax Rates

New York S Death Tax The Case For Killing It Empire Center For Public Policy

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States With No Estate Tax Or Inheritance Tax Plan Where You Die

Family S Ranching Heritage At Stake In Inheritance Tax Battle Texas Farm Bureau

Texas State Taxes Forbes Advisor

What Is Inheritance Tax And How Much Is It

Talking Taxes Estate Tax Texas Agriculture Law

3 Reasons Why Almost Every State Except Nebraska Ended Its Inheritance Tax

How Do State Estate And Inheritance Taxes Work Tax Policy Center